What is an SR22 filing?

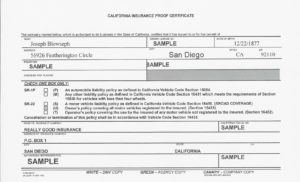

It is a digital link from your California auto insurance carrier to the DMV that lets the DMV know if you are insured or not. An SR-22 filing is basically a document you get from your auto insurance or motorcycle insurance carrier that creates a communication link between your insurance company and the Department of Motor Vehicles (DMV) that indicates to the DMV that you are being “Financially Responsible”. In other words, if you have an accident where you are deemed to be at fault, you will have auto or motorcycle insurance coverage in effect for the other driver (liability insurance).

2) Who needs an SR-22 filing?

Typically people that need an SR-22 fall into 1 of 3 categories:

– They have been cited for Driving Under the Influence (DUI) or Reckless (or other major violation).

– They have been involved in an accident while they weren’t insured (fault in the accident is not relevant).

– They have had too many points on their driving record in a short span of time.

3) How long do you need to carry an SR-22 filing?

That can vary depending on why you were required to get an SR-22. Typically you need to file the SR-22 for 3 years for DUI type violations and 4 years for accidents without insurance. These requirements can vary depending on your personal circumstances so be sure to ask the DMV for specifics that relate to your driver’s license.

4) What happens if I cancel my insurance while I’m required to carry an SR-22 filing?

Once your insurance policy expires or cancels, for whatever reason, your insurance company is required to notify the DMV immediately. Typically they will suspend your drivers license within a few days to a couple of weeks depending on how fast your carrier reports it to the DMV.

5) How much does an SR-22 cost?

Typically the most an SR-22 costs is about $20 but in some cases it is free. There is not a monthly recurring charge for the fee. You pay the fee up front on the policy when you buy it, and in some rare cases, each year when you renew.

6) How do I get an SR-22 filing and how long does it take?

Simply ask your auto insurance agent for the form. Some insurance companies don’t insure drivers that are required to carry an SR-22 so it may be necessary to change to an insurance company that does issue them, such as McCormick Insurance. We issue the SR-22 filing immediately and provide you with the form to take to the DMV so you’ll have it in a just a few minutes. Some carriers mail them to the DMV in Sacramento or file them electronically – beware, electronic filing of an SR22 is not nearly as quick and efficient as it sounds. Either of these methods can take weeks to get entered into the DMV’s system once they receive them, and in most cases you will owe the DMV a license reinstatement fee that needs to be paid in person anyways.

When McCormick Insurance issues an SR-22, we give you an original to take to the DMV, then we mail and file electronically as well – all 3 ways just to give an added measure of security that it is done for sure.

IMPORTANT NOTE: A lot of people buy “Non-owners” policies with an SR22 as a less expensive way of getting the SR22. Keep in mind that a non-owner policy only provides coverage for liability, and maybe medical payments or uninsured motorist. That means no coverage for collision. So if a person with a non-owner policy drives somebody else’s car thinking they are fully covered, they aren’t covered by the non-owner policy for damages to the car they are borrowing.

A non-owner policy will not cover you in the following situations:

Driving a car you own (you would need an regular policy.)

Driving a family member’s or household member’s car.

Driving a car you have regular access to.

Driving a company owned vehicle.